We’ve been over the numerous BS excuses that US Dollar destroyer extraordinaire Ben Bernanke has made for QE enough times that today I’d rather simply focus on the REAL reason he continues to funnel TRILLIONS of Dollars into the Wall Street Banks.

I’ve written this analysis before. But given the enormity of what it entails, it’s worth repeating. The following paragraphs are the REAL reason Bernanke does what he does no matter what any other media outlet, book, investment expert, or guru tell you.

Bernanke is printing money and funneling it into the Wall Street banks for one reason and one reason only. That reason is: DERIVATIVES.

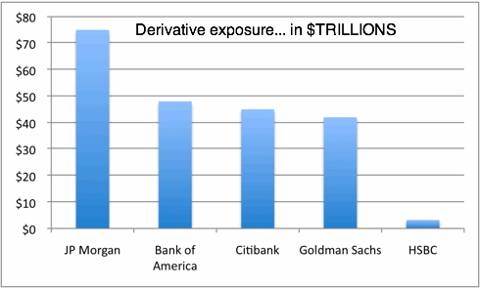

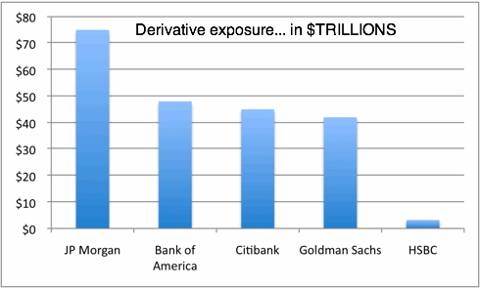

According to the Office of the Comptroller of the Currency’s Quarterly Report on Bank Trading and Derivatives Activities for the Second Quarter 2010 (most recent), the notional value of derivatives held by U.S. commercial banks is around $223.4 TRILLION.

Five banks account for 95% of this. Can you guess which five?

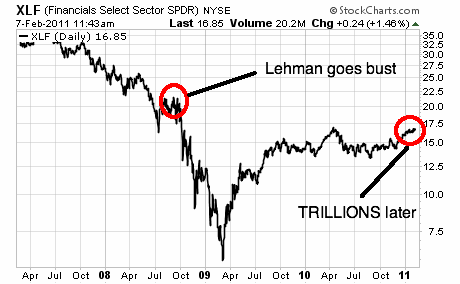

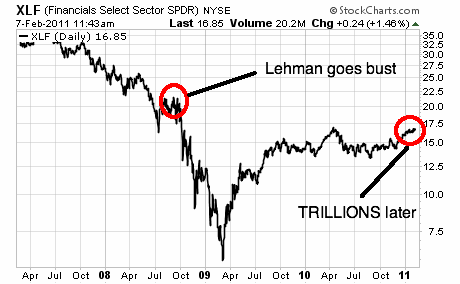

Looks a lot like a list of the banks that Ben Bernanke has focused on bailing out/ backstopping/ funneling cash since the Financial Crisis began, doesn’t it? When you consider the insane level of risk exposure here, you can see why the TRILLIONS he’s funneled into these institutions has failed to bring them even to pre-Lehman bankruptcy levels.

Source: http://blacklistednews.com/Derivatives%3A-The-Real-Reason-Bernanke-Funnels-Trillions-Into-Wall-Street-Banks-/12643/0/13/13/Y/M.html

I’ve written this analysis before. But given the enormity of what it entails, it’s worth repeating. The following paragraphs are the REAL reason Bernanke does what he does no matter what any other media outlet, book, investment expert, or guru tell you.

Bernanke is printing money and funneling it into the Wall Street banks for one reason and one reason only. That reason is: DERIVATIVES.

According to the Office of the Comptroller of the Currency’s Quarterly Report on Bank Trading and Derivatives Activities for the Second Quarter 2010 (most recent), the notional value of derivatives held by U.S. commercial banks is around $223.4 TRILLION.

Five banks account for 95% of this. Can you guess which five?

Looks a lot like a list of the banks that Ben Bernanke has focused on bailing out/ backstopping/ funneling cash since the Financial Crisis began, doesn’t it? When you consider the insane level of risk exposure here, you can see why the TRILLIONS he’s funneled into these institutions has failed to bring them even to pre-Lehman bankruptcy levels.

Source: http://blacklistednews.com/Derivatives%3A-The-Real-Reason-Bernanke-Funnels-Trillions-Into-Wall-Street-Banks-/12643/0/13/13/Y/M.html

No comments:

Post a Comment